Solving the Real Problems That Your Business Faces

We provide marketing and business finance solutions to owners and CEOs across the USA and globally. Our mission is to help you scale and capitalize by connecting you with funding partners through Kapitus on behalf of David Marketing Solutions Ad Agency. Additionally, we offer high-ticket services designed to reduce your annual tax burden under IRS Codes 179 and 181. More recently, we will expand our offerings to include payment processing products that help small- to mid-sized business owners save thousands annually on processing fees.

Get A Business Loan

New business loans are all funded through Kapitus Finances. Kapitus has been around for less than 20 years since 2006, and has successfully funded over 65,000 businesses. The most popular product they serve is business term loan rates . Check it out to learn more about interest rates, pre-approval qualifications, and more.

Digital Marketing Services

In today’s online digital marketing landscape, consumer behavior is adapting and changing second by second. Are you keeping up or slipping behind the 8-ball? Ask more about our digital marketing services that can get you online sales and be seen in front of the right audience at the right time.

Merchant Services

Our new product to offer to the world, is now physical payment terminal equipment and virtual terminals to save the cost of credit card payment fees. Save thousands of dollars per year and pass down the fees to the customer.

Kapitus Pre Qualifications: – Flexible Terms That Meets Your Needs

-Must have 2 years active in business,

-A personal credit score of 650 minimum,

-Generate over 250k revenue

-Business must be in the United States

-Soft Credit Pull and terms can go up to 80 months

Get funded in as little as 4 hours based on approval and loan amount. Finance from $10,000 up to 5 million for loan funding. Kapitus is a multitude lender that have a network of lending partners to guide you to your next funding.

Tax Strategy For The Modern CEO Professional

Section 179 Software Tax Deduction (5:1 Strategy Explained)

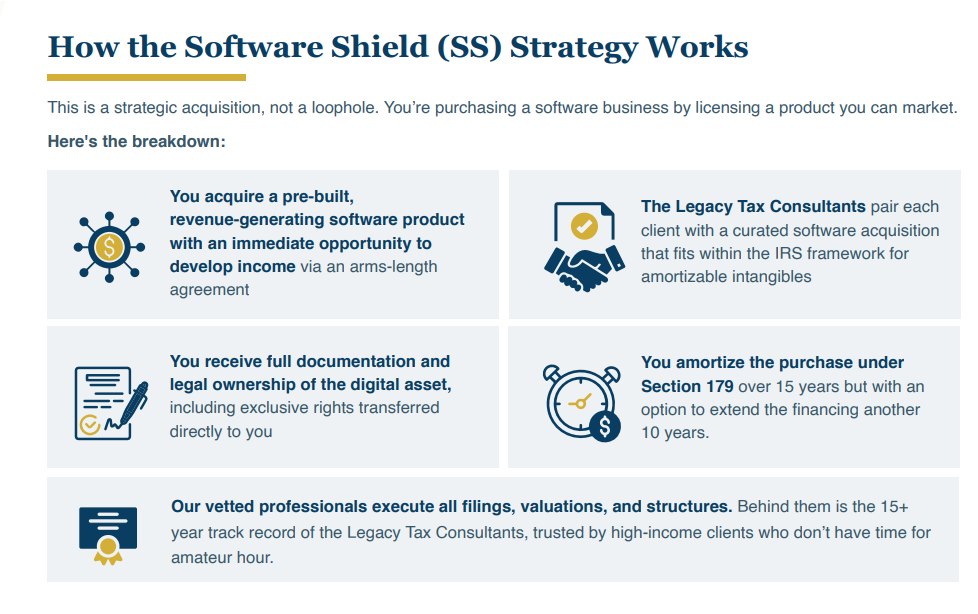

The Software Shield is a business-friendly tax strategy that allows companies to use IRS Section 179 to deduct the cost of eligible software purchases made before the end of the year.

To qualify, software must be off-the-shelf, commercially available, and ready for use by the general public. When properly structured, these purchases can support a 5:1 tax deduction by establishing legitimate business ownership and a clear path to future income through marketing, licensing, or development—while staying fully IRS-compliant.

Common Section 179-eligible software includes:

- Microsoft Office and productivity suites

- QuickBooks and accounting software

- Standard CRM and SaaS platforms

These tools qualify because they are widely used, revenue-supporting, and meet IRS Section 179 requirements for business software deductions.