Tax Strategy for the Modern CEO & Professional

Maximize Tax Savings with Section 179 Software Deductions

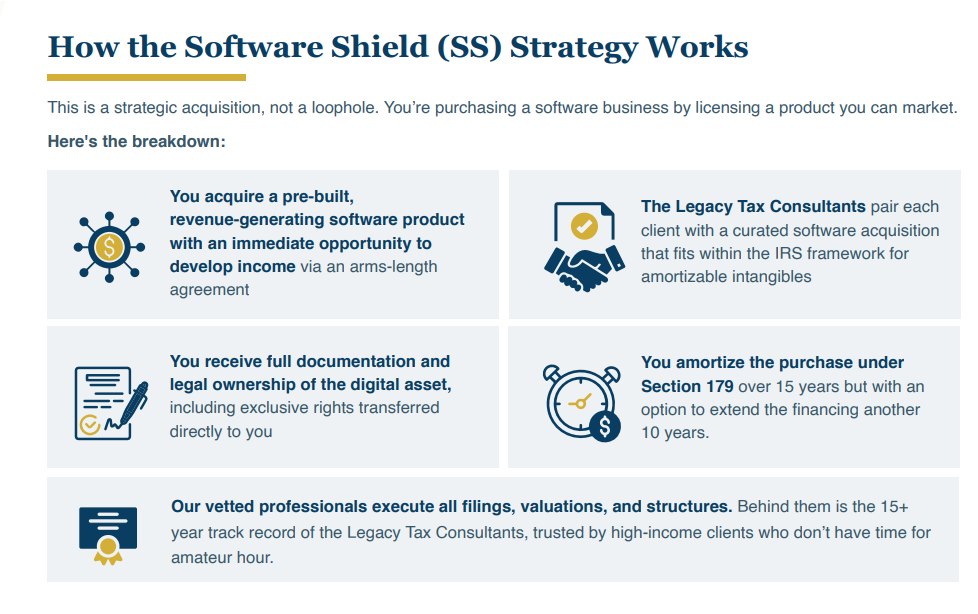

As a business leader, strategically managing taxes can make a significant impact on your bottom line — especially before year-end. One of the most powerful tools available is Section 179 of the Internal Revenue Code, which allows eligible businesses to write off the full cost of qualifying software and technology in the year it’s purchased and placed into service.

With thoughtful planning, this strategy can help you reduce taxable income, improve cash flow, and reinvest in growth-driving systems such as CRM platforms, productivity suites, and essential SaaS tools.

What Is Section 179 and Why It Matters

Section 179 lets businesses deduct the cost of qualifying property — including off-the-shelf software and technology — in the same year those assets are placed into service instead of depreciating them over several years.

This accelerated deduction can:

- Lower your current year tax liability

- Free up cash flow for reinvestment

- Encourage smart technology investments

- Help modern CEOs leverage key tools to scale operations

Unlike standard depreciation methods, Section 179 is designed to benefit small and mid-sized businesses investing in growth and technology.

CPA Experts Manage the Entire Process

Join a 30-minute strategy virtual call to determine eligibility. The first virtual call would be an introduction discovery call. Reviewed by elite CPAs, attorneys, and ex-IRS professionals, who bring oversight to every structure. Vetted with 15 plus years of experience. Behind them is the 15+

year track record of the Legacy Tax Consultants, trusted by high-income clients who don’t have time for

Amateur hour. America’s top 1% —delivered by a Forbes-ranked team of PhDs, CPAs, CFPs, JDs, LLMs, CHFCs, CLUs, CEPAs, and Master’s-level specialists with over a century of combined expertise.

Software Purchase 179 Tax Deduction Real-World Scenarios

Across each of these cases, The Legacy Tax Consultants have structured the acquisition and compliance strategy

to ensure the client walks away with both a viable asset and a serious tax advantage, all with minimal effort on

their part.

What The Legacy Tax Consultants (LTC) Do for You

This strategy is precisely structured to meet IRS standards and provide solid documentation throughout. From purchase to amortization, every detail complies with regulations and demonstrates real economic substance. Third-party software valuations confirm the asset’s fair market value. Signed purchase agreements verify legal ownership transfer. Amortization schedules fully align with Section 179 of the Internal Revenue Code. Evidence of economic control and activity supports compliance.

-Vetting and carefully selecting highly qualified software assets that demonstrate real, verifiable revenue streams and maintain an active, engaged user base

– Drafting comprehensive and robust purchase agreements that are specifically designed to withstand thorough professional review and ensure clear terms

-Transferring complete and full legal rights to both the software and its entire customer base, thereby creating tangible and measurable economic value

-Providing detailed amortization schedules along with all necessary supporting documents to facilitate accurate and compliant financial filings

-Offering timely early disposition advice whenever it is strategically beneficial to enhance overall outcomes and add value

-Collaborating closely and effectively with your CPA or legal team to ensure a smooth, seamless, and confident execution process from start to finish.